Contents

- 1 What is Kisan Vikas Patra (KVP)?

- 2 Key Features of Kisan Vikas Patra in 2025

- 3 Current Interest Rate of KVP (April to June 2025)

- 4 Eligibility Criteria for KVP Investment

- 5 Required Documents to Purchase KVP

- 6 How to Invest in Kisan Vikas Patra: Step-by-Step Guide

- 7 Where to Buy KVP: Online and Offline Options

- 8 How Kisan Vikas Patra Doubles Your Investment

- 9 KVP vs NSC vs FD: Which One Wins?

- 10 Tax Implications on KVP Investments

- 11 How to Redeem KVP Before or After Maturity

- 12 Can NRIs Invest in Kisan Vikas Patra?

- 13 KVP Nomination, Transfer, and Pledge Rules

- 14 Pros and Cons of Investing in Kisan Vikas Patra

- 15 KVP Real-Life Example: Doubling Calculation

- 16 Expert Advice for Maximizing Returns with Kisan Vikas Patra

- 17 Government Announcements About KVP

- 18 FAQs – Kisan Vikas Patra (2025)

- 19 Conclusion: Is KVP the Right Investment for You in 2025?

What is Kisan Vikas Patra (KVP)?

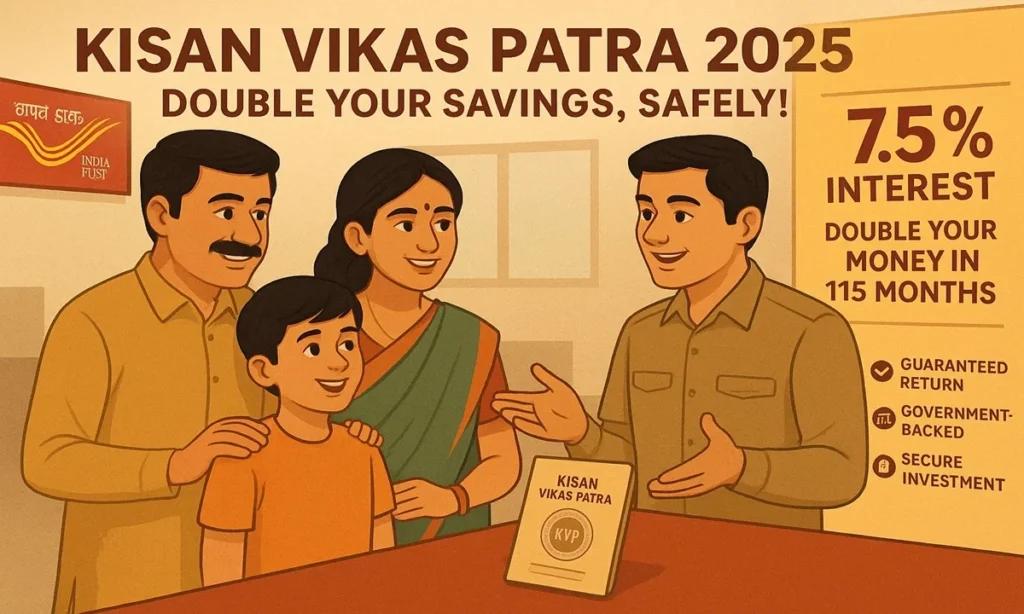

Kisan Vikas Patra (KVP) is a fixed-income savings scheme offered by the Government of India, designed to encourage long-term financial planning among small and mid-income investors. First introduced in 1988, KVP aims to promote a habit of savings while offering a guaranteed return.

One of the key attractions of KVP is its money-doubling feature. Depending on the prevailing interest rate, your investment in KVP will double over a fixed period (currently around 115 months, i.e., 9 years and 7 months). The scheme is managed by India Post and can be accessed through any post office branch across the country.

Key Features of Kisan Vikas Patra in 2025

Kisan Vikas Patra has been updated over the years to align with the financial goals of modern investors. Here’s what makes it an attractive option in 2025:

- 🔒 Guaranteed Return: Backed by the government, making it safe.

- 📈 Current Rate (Q1 2025): 7.5% p.a., compounded annually.

- 💸 Money Doubles in: 115 months (9 years & 7 months).

- 🔁 Minimum Investment: ₹1,000 (no maximum limit).

- 👥 Available for: Individuals (single or joint account holders), minors through guardians.

- 🏦 Transferable: From one post office to another or to another person.

- 📄 Nomination Facility: Available at the time of purchase.

- 💼 Pledge Option: Can be pledged to banks or other authorities for loans.

💡 Unlike some market-linked instruments, KVP is not subject to market risk and offers a predictable return—perfect for conservative investors.

Current Interest Rate of KVP (April to June 2025)

As of Q1 FY 2025-26, the interest rate for KVP is fixed at 7.5% per annum, which allows the invested amount to double in approximately 115 months.

| Period | Interest Rate | Maturity Duration | Doubling Period |

|---|---|---|---|

| Apr–Jun 2025 | 7.5% p.a. | 115 months | ₹1,000 → ₹2,000 |

Note: The Ministry of Finance reviews interest rates quarterly. Visit India Post’s official site for the latest rates.

Eligibility Criteria for KVP Investment

Anyone who falls under the following categories is eligible to invest in Kisan Vikas Patra:

- Resident Indian citizens aged 18+

- Minors through parents or legal guardians

- Joint account holders (up to two adults)

- Hindu Undivided Families (HUFs) and Non-Resident Indians (NRIs) are not eligible

Required Documents to Purchase KVP

You’ll need the following documents to purchase a Kisan Vikas Patra certificate from your nearest post office:

- Aadhaar Card – Mandatory as per KYC norms

- PAN Card – Required if investment exceeds ₹50,000

- Recent passport-size photograph

- Proof of Address – Voter ID, Utility Bill, Passport, etc.

- Filled KVP Application Form (Form A)

- Cash, cheque, or transfer through post office savings account

How to Invest in Kisan Vikas Patra: Step-by-Step Guide

Here’s how you can easily invest in Kisan Vikas Patra:

- Visit your nearest post office.

- Request and fill the KVP Application Form (Form A).

- Submit required KYC documents (Aadhaar, PAN, Address proof).

- Decide the investment amount (minimum ₹1,000).

- Make payment via cash/cheque/postal savings account.

- You’ll receive a KVP passbook or e-certificate.

⏩ Digital facilities like online investment and redemption are under development but not yet fully functional for KVP in 2025.

Where to Buy KVP: Online and Offline Options

Offline Mode:

- Available at all post offices across India

- Also available at selected nationalized banks (subject to regional availability)

Online Mode (limited functionality):

- Internet banking via India Post is being rolled out gradually

- Mobile app support and e-KVP features are expected later in 2025

📢 Always retain your investment proof (passbook or digital receipt) to avoid issues at maturity.

How Kisan Vikas Patra Doubles Your Investment

The unique selling point of KVP is that it doubles your money over a fixed tenure. The current tenure is 115 months (9 years and 7 months) at an annual interest rate of 7.5%.

💡 Example:

If you invest ₹1,00,000 in KVP today:

- At 7.5% interest rate

- In 115 months, you’ll receive ₹2,00,000

- No compounding confusion—your investment simply doubles

KVP works on compound interest, calculated annually and paid at maturity.

KVP vs NSC vs FD: Which One Wins?

Let’s compare KVP with National Savings Certificate (NSC) and a typical Fixed Deposit (FD):

| Feature | KVP | NSC | Fixed Deposit |

|---|---|---|---|

| Interest Rate | 7.5% p.a. | 7.7% p.a. | 6–7.5% (varies) |

| Tenure | 115 months | 5 years | 1–10 years |

| Tax Benefit | No | Yes (80C) | Only in tax-saving FDs |

| Return Type | Doubles investment | Compounded annually | Depends on bank |

| Risk Level | Very Low | Very Low | Low to Medium |

Verdict: Choose KVP for simple, secure money doubling; NSC if you want tax savings; FDs if you need flexibility.

Tax Implications on KVP Investments

While Kisan Vikas Patra offers guaranteed returns, it’s important to understand its tax treatment before investing:

✅ Tax on Principal:

- No tax deduction available under Section 80C for KVP investments.

- Entire investment amount is taxable based on your income slab.

❌ Tax on Interest:

- The interest earned is taxable as per the individual’s applicable slab.

- Since the interest is not paid annually but at maturity, it is taxed in the year of maturity.

⚠️ TDS:

- No TDS (Tax Deducted at Source) is applied at the time of maturity.

- However, you are responsible for declaring interest income in your ITR.

🔍 Example:

If you invest ₹1,00,000 and receive ₹2,00,000 at maturity (after 115 months), then ₹1,00,000 will be treated as interest income and taxed in the year you receive it.

How to Redeem KVP Before or After Maturity

Kisan Vikas Patra is designed as a long-term saving tool, but here’s how redemption works:

✅ On Maturity:

- Visit the issuing post office with:

- Original KVP certificate or passbook

- Valid ID proof

- Filled Form 2 (claim form)

- Amount will be credited to your savings account or paid in cash (if amount is small)

❌ Premature Withdrawal is allowed only under specific circumstances:

- Death of the account holder or joint holder

- Court order

- Forfeiture by a pledgee (e.g., in case of loan default)

📌 There’s no partial withdrawal or premature exit for general financial needs.

Can NRIs Invest in Kisan Vikas Patra?

No, Non-Resident Indians (NRIs) are not eligible to invest in Kisan Vikas Patra.

However, if an individual invests in KVP as a resident and later becomes an NRI:

- The investment remains valid till maturity.

- No fresh investment or reinvestment is allowed after status changes to NRI.

- Maturity amount must be credited to a Non-Resident Ordinary (NRO) account.

KVP Nomination, Transfer, and Pledge Rules

✅ Nomination:

- You must fill Form C at the time of investment.

- Nominee can claim amount in case of the depositor’s death.

- You can add or cancel nominations later by submitting a fresh form.

🔁 Transfer of KVP:

- Allowed once before maturity under conditions such as:

- Transfer to heir/legal guardian

- Based on court orders

- From one post office to another

- Use Form B for transfer requests.

💼 Pledge or Lien:

- You can pledge your KVP as collateral security for loans from:

- Banks

- Cooperative societies

- Financial institutions

- Submit Form D with lender’s acceptance letter.

Pros and Cons of Investing in Kisan Vikas Patra

Here’s a quick glance at the benefits and drawbacks:

✅ Pros

- Guaranteed return backed by the government

- Doubles your investment over time

- Easily available at post offices

- Can be used as security for loans

- No TDS deducted at source

❌ Cons

- No tax benefit under 80C

- Interest is fully taxable

- Long lock-in period (9 years, 7 months)

- Limited liquidity (restricted premature withdrawal)

KVP Real-Life Example: Doubling Calculation

Let’s take a practical example to understand how your investment grows:

| Initial Investment | Interest Rate | Maturity Period | Maturity Value |

|---|---|---|---|

| ₹10,000 | 7.5% | 115 months | ₹20,000 |

| ₹50,000 | 7.5% | 115 months | ₹1,00,000 |

| ₹1,00,000 | 7.5% | 115 months | ₹2,00,000 |

💬 This makes KVP ideal for goal-based investing like:

- Children’s education

- Wedding expenses

- Retirement corpus

Expert Advice for Maximizing Returns with Kisan Vikas Patra

- Ladder Your Investment: Instead of one-time bulk investment, spread out your investments over time to get better liquidity.

- Use for Safe Portfolio Allocation: Allocate 20–30% of your savings in KVP for risk-free stability.

- Avoid Early Closure: Stick to the full tenure to get the maximum return.

- Track Maturity: Maintain a reminder system so that you redeem your KVP on time.

- Use for Loan Collateral: You can easily pledge KVPs if you need emergency funds.

Government Announcements About KVP

Here are some of the latest official updates as of 2025:

- 🔄 e-KVP certificates: Pilot phase initiated for digital versions.

- 📲 Mobile banking integration: Expected in Q3 2025 via India Post Payments Bank app.

- 📉 No changes in interest rates for April-June 2025; KVP continues at 7.5%.

- 🔐 New KYC norms introduced to ensure transparency and compliance with PMLA rules.

For updates, always check India Post’s official website.

FAQs – Kisan Vikas Patra (2025)

Q1. Can I invest more than ₹10 lakh in KVP?

Yes, there is no upper limit on investment in KVP.

Q2. Is KVP interest compounded or simple?

It is compounded annually and paid out at maturity.

Q3. Is there any age limit for investing in KVP?

No specific age limit. Anyone above 18 can invest, and guardians can invest on behalf of minors.

Q4. What happens if I lose the KVP certificate?

You can apply for a duplicate certificate by submitting a written application and proper ID proof.

Q5. Can I encash KVP from any post office?

Usually, redemption is done at the issuing post office, but with prior request, you may be allowed redemption at another branch.

Q6. Is KVP better than bank FD?

For long-term savings with doubling returns and government backing, KVP may offer better safety, but FD may offer more liquidity.

Conclusion: Is KVP the Right Investment for You in 2025?

If you’re seeking a safe, long-term investment with guaranteed returns, Kisan Vikas Patra is a solid choice. Though it lacks tax benefits, its simplicity, fixed growth, and sovereign guarantee make it attractive—especially for rural investors, senior citizens, and risk-averse individuals.

Whether you’re building a financial base for the future or simply looking to double your money reliably, KVP fits the bill. Just remember to declare the maturity interest in your ITR and plan your liquidity accordingly.